Project Overview: Building a credit management dashboard

Fundbox helps small businesses overcome cash flow gaps through short-term loans based on personalized

credit assessments.

- Goal:

Enable users to advance funds against their existing invoices. - Background:

Small businesses are often declined by traditional banks due to perceived risk. Fundbox developed a proprietary assessment protocol to offer safe, flexible credit. Users can request advances on invoices they've already issued, up to the amount approved through this protocol. - Discovery:

I studied financial and banking dashboards to identify standard patterns and best practices in transaction management. - Hypothesis:

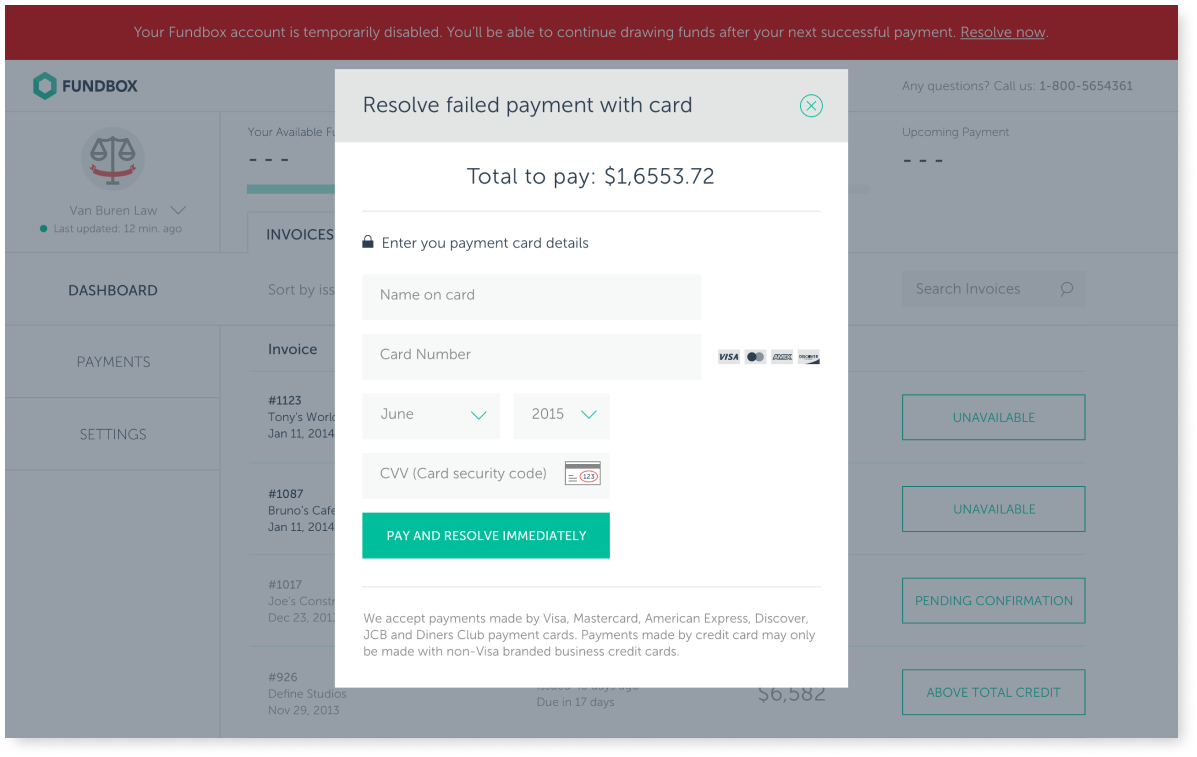

Trust is critical in financial products. A clear, intuitive interface that promotes transparency would foster user confidence and reduce friction. - Outcome:

- Within the first three years post-launch, the customer base grew to over 12,000 monthly active users.

- During my time at Fundbox, the company raised over $100M in funding.

- Users regularly reported easy and seamless setup and usage, indicating an intuitive and trusted user experience.

Research

Examining layouts, navigation models, and user flows in leading banking platforms helped shape a dashboard experience that aligns with user expectations and existing mental models.

Solution

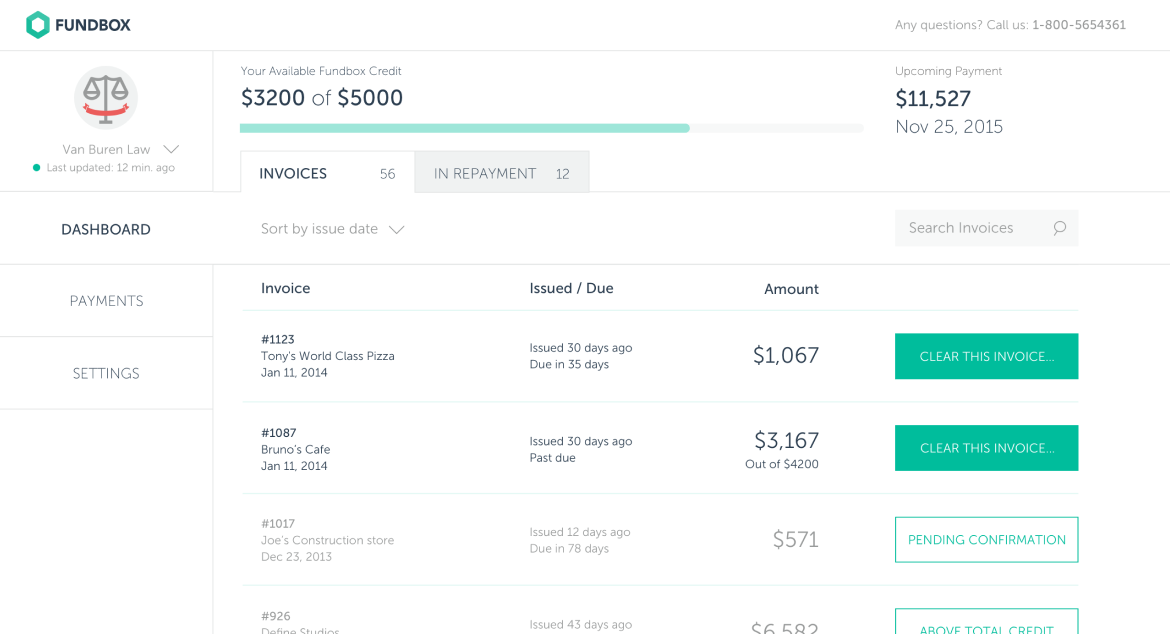

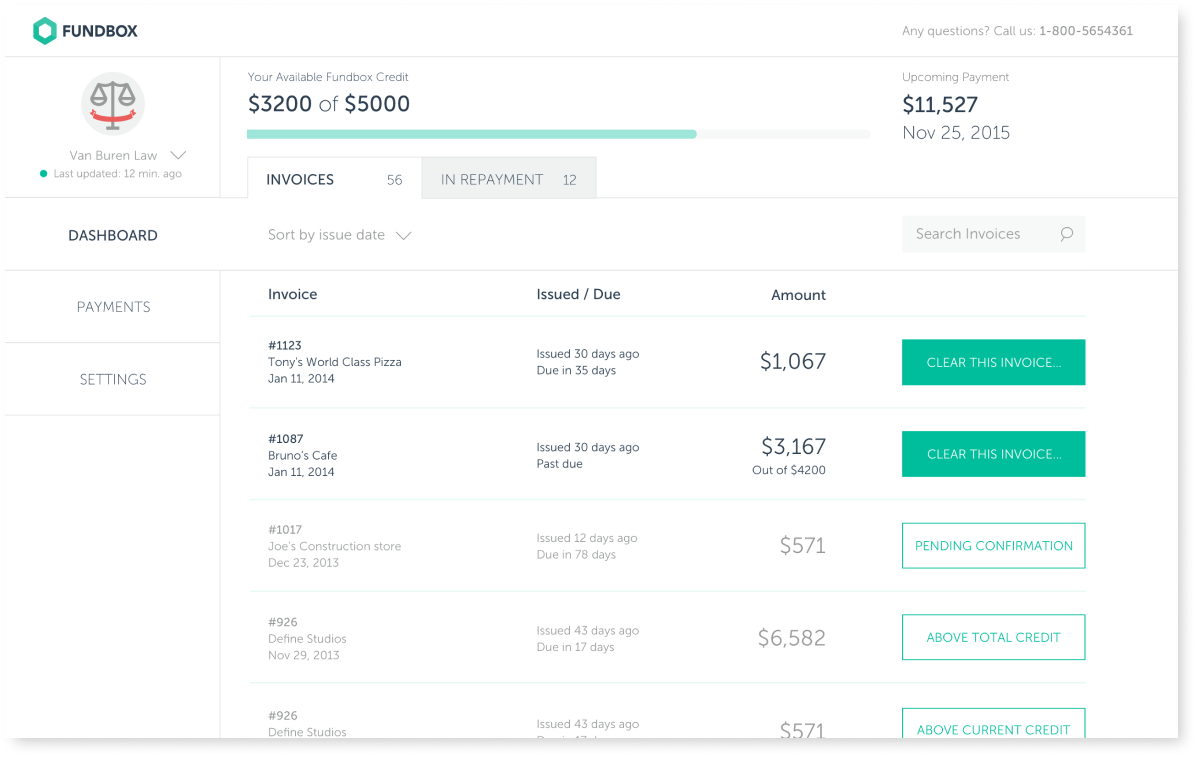

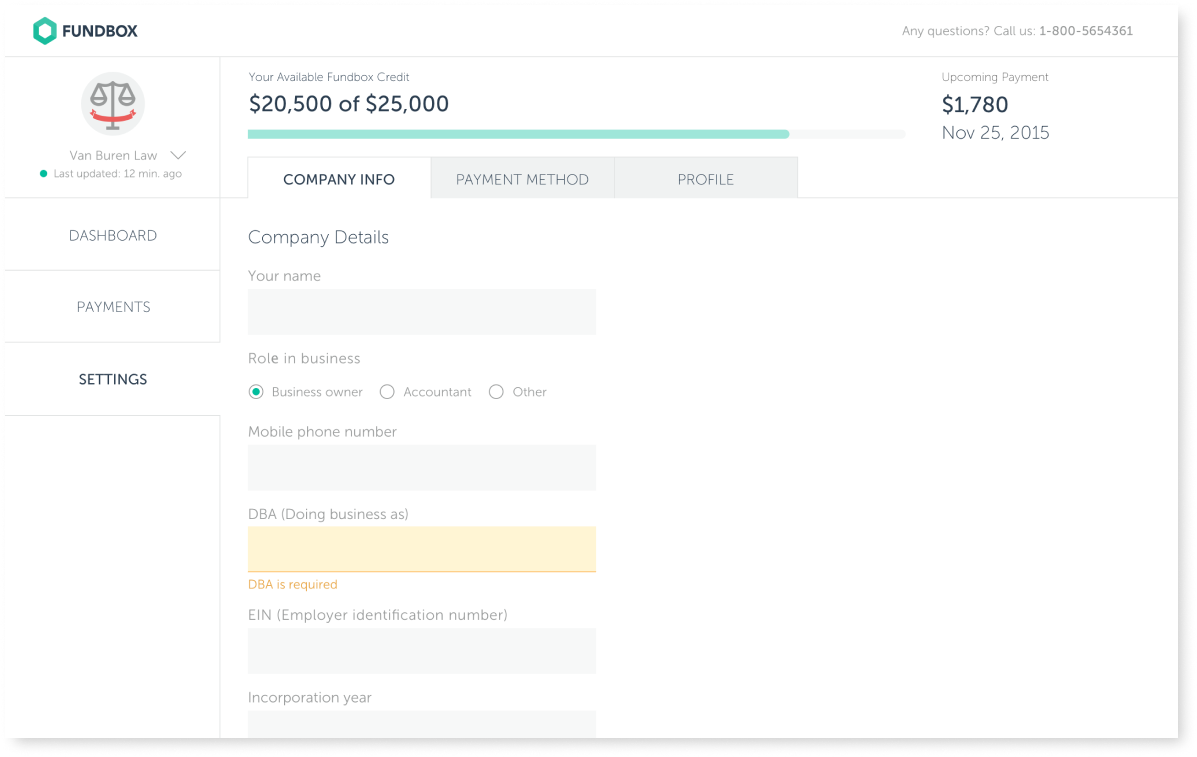

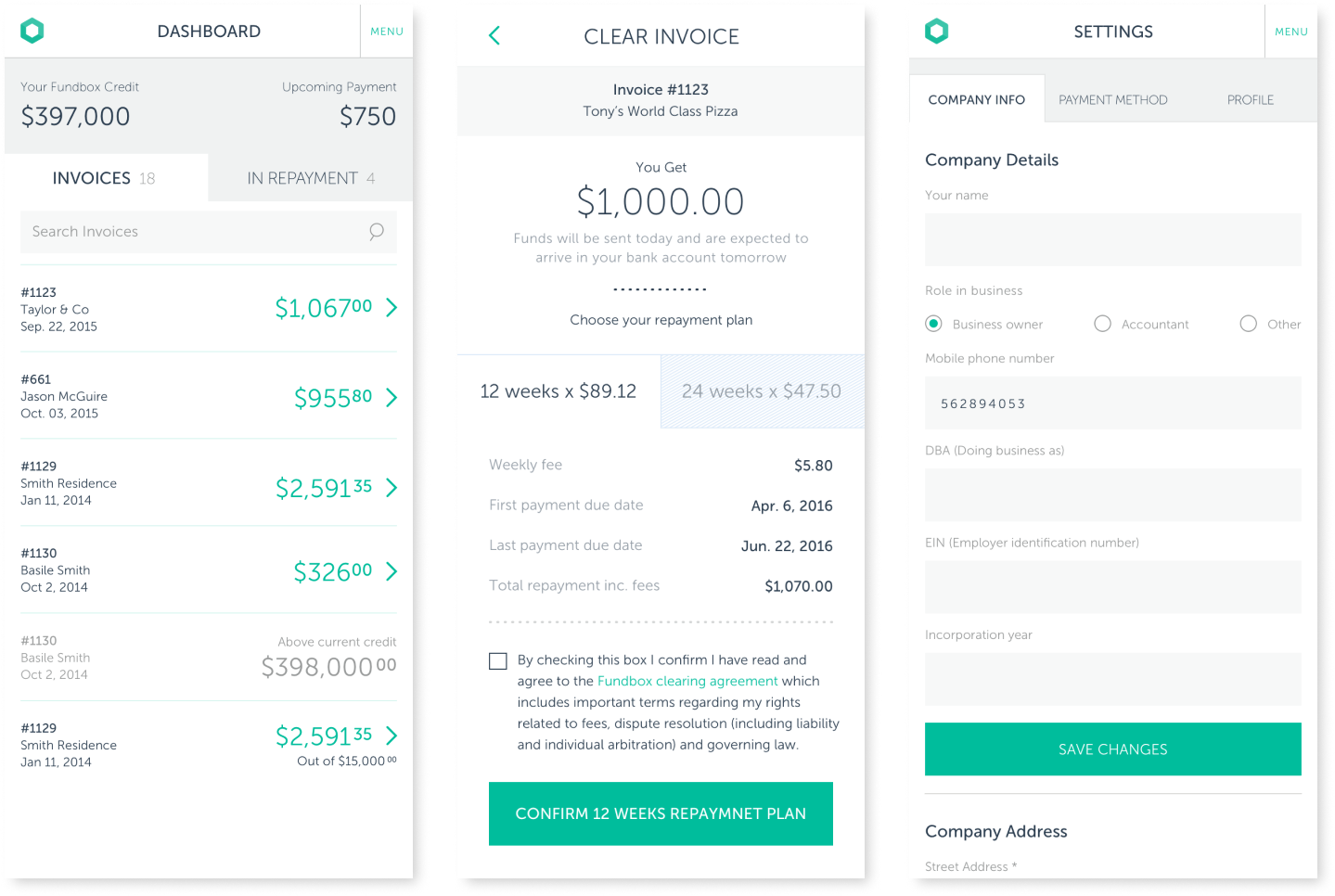

The dashboard was designed to be minimal, action-oriented, and confidence-inspiring. It consists of three streamlined components:

- Credit bar: Displays available credit and upcoming payment at the top of the screen.

- Invoice list: Automatically populated from the user's accounting software.

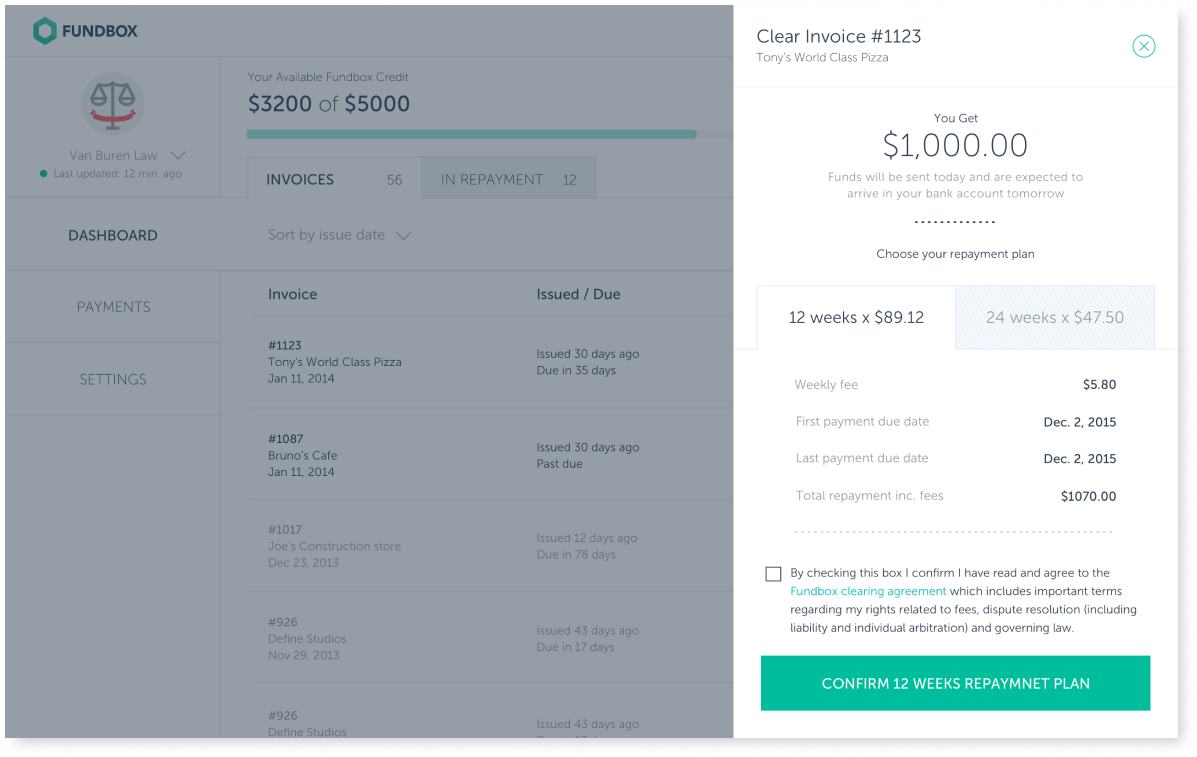

- Side panel: Opens when an invoice is selected, allowing users to request an advance.

Each section presents only the relevant details to reduce cognitive load. A single, prominent call-to-action at all times keeps users focused on completing their tasks.

Results

Staying close to industry standards and users' familiar patterns led to high task completion rates.

The design effectively reinforced trust while enabling users to take action with ease.